05_never_again

Well-Known Member

- Joined

- Aug 28, 2006

- Messages

- 27,059

- Likes

- 25,598

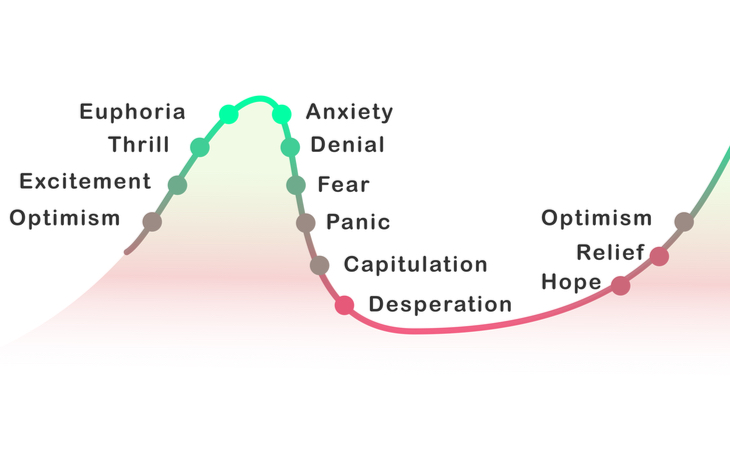

Is it written in stone that the bottom, whenever it comes, has to be a dramatic capitulation with fear, panic selling, etc. Or could it just be a day like yesterday?

Market sentiment has been bearish for months. Ask Mr. Orange.No, but has there been a major market bottom when people were confident and optimistic and the news was good?

I can't say if there's a mechanical reason for "this time is different," but I'm thinking the post-COVID era has been funky in so many ways that we should almost expect to be surprised on this (the shape of "the bottom") too.Computerized trading has changed the deal. It isn’t new. It has been around a long time. But the algorithms are more sophisticated at predicting the tendencies of the human traders. They also sell every rally hard so pulling out of the lows is far more drawn out. It is going to take solid, consistent profits to get markets moving again. The full employment will fuel profits - but the Fed is targeting employment to try to hit that 2% inflation goal.

Has it? There are certainly more bears now than there were at the start of the year, but based on the market's reaction to things like Powell's comments the other day and the CPI print, there were a significant amount of market participants who thought the Fed was closer to the end of this tightening cycle than the beginning. I am not completely sure why - inflation does not appear to be moving lower yet in response to rate hikes (even when you consider the lag) - but the fact that some people were surprised by this kind of tells me we aren't at or near a bottom. I'd be way more bullish if the market was flat, or even rallied, in response to news considered "bad."Market sentiment has been bearish for months. Ask Mr. Orange.

I don't believe we're at the bottom, but if news on the inflation front got much better we hypothetically could be. A mild recession is already priced in.

I can't say if there's a mechanical reason for "this time is different," but I'm thinking the post-COVID era has been funky in so many ways that we should almost expect to be surprised on this (the shape of "the bottom") too.

As for your second part, I know you're always talking fundamentals, but right now I think the dispositive factor on the direction of the market is inflation/Fed/interest rates. If they're tightening beyond expectations, I don't think decent earnings are going to save the ship.

Should probably more clearly differentiate between sentiment of institutional investors versus retail investors. If the latter is bearish, one is going to see it a lot more on social media.Has it? There are certainly more bears now than there were at the start of the year, but based on the market's reaction to things like Powell's comments the other day and the CPI print, there were a significant amount of market participants who thought the Fed was closer to the end of this tightening cycle than the beginning. I am not completely sure why - inflation does not appear to be moving lower yet in response to rate hikes (even when you consider the lag) - but the fact that some people were surprised by this kind of tells me we aren't at or near a bottom. I'd be way more bullish if the market was flat, or even rallied, in response to news considered "bad."

Hey Guys! First post! I am brand new to trading… any pointers on where to start learning how to’s and the information I will need to not completely be lost… starting small for awhile to get the hang of it. Not primary income so I can afford to learn.

Has it? There are certainly more bears now than there were at the start of the year, but based on the market's reaction to things like Powell's comments the other day and the CPI print, there were a significant amount of market participants who thought the Fed was closer to the end of this tightening cycle than the beginning. I am not completely sure why - inflation does not appear to be moving lower yet in response to rate hikes (even when you consider the lag) - but the fact that some people were surprised by this kind of tells me we aren't at or near a bottom. I'd be way more bullish if the market was flat, or even rallied, in response to news considered "bad."

IMO, a good rule of thumb is that we're near a bottom when bulls either flip or kind of give up trying to pick the bottom. Much like we're near a top when bears either flip or give up trying to call the top. I think there is a difference between general bearish sentiment and capitulation.

ThisThe bigger do-it-yourself brokers like Ameritrade, Schwab (same company as Ameritrade - just not yet consolidated), E*Trade, and Fidelity all have “learning center” links on their websites to all sorts of topics.

Yahoo Finance has a ton of information.

Investopedia dot com is one of the best resources. Search pretty much any term and there will be an article with the definition on it, usually with multiple sub-articles giving different perspectives.

Motley Fool dot com has lots of information, but they work hard to get visitors to buy their paid subscription.

I’m sure that there is an “Investing for Dummies” book. Maybe even a series of topics.

it’s difficult at first, but it won’t take too long to grasp enough to participate in investing.

There are 2 BASIC investments - (1) equities (or shares of stock) and (2) debt (bonds or loans - either as the borrower or the lender). So there are 4 fundamental investing positions - buying or selling equities or debt.

FUNDS package securities into large pools that are sliced up into shares of the entire investment product. Mutual funds were the most pooular type of fund until about 20 years ago. Now exchange traded funds (or ETFs) are the most common type of fund. There are variants of ETFs such as UITs. The difference is mostly the legal organization or administration of the “funds”. Funds are the best place for new investors to get started.

Understanding the types of ACCOUNTS is important. IRAs, 401(k)s, Roth IRAs, Roth 401(k)s, annuities, standard taxable brokerage accounts, etc.

DIVERSIFICATION is one of the most important concepts to be familiar with. DOLLAR COST AVERAGING is important when growing a portfolio of investments. DIVIDEND YIELDS (and dividends per share and earnings per share) and the P/E ratio (price/earnings) are important fundamental concepts with individual stocks. The management fees are important with funds. LONG is the position of owning an investment. SHORT is the opposite (and is VERY risky). When SHORTING you sell a security initially to open a position (and you actually borrow the security from an owner of the security) and then you buy it later to close the position. BULLS (or being bullish) have a positive sentiment and BEARS (or being bearish) have a negative sentiment.

DERIVITIVES are investment vehicles that “derive” their valuation based on other assets. Stock options are a very common type of derivative. Stock options are contracts and have a limited lifespan. Shares of stock on the other hand can exist for many generations of human lives.

Stocks can be publicly traded or privately held. Often privately held stock will be converted (sold) to become publicly traded stocks through IPOs (initial public offerings). SC Johnson (household products), Mars (candy), and Pilot Oil are some of the largest private companies although Pilot is now mostly owned by Berkshire-Hathaway which is a publicly traded company that is controlled by Warren Buffett.

The fundamentals of accounting can be important. Assets, liabilities, and equity account balances are reported on company balance sheets as of a specific point in time. Income statements show a company’s revenues and expenses over a time frame (typically a year, quarter, or a month). The net income or net loss is the bottom line of an income statement and is the difference in those two accounts (revenues minus expenses). There are 5 primary types of “accounts” with accounting. Assets, liabilities, equity, revenue, and expense. There are actually formulas for them. Assets minus liabilities equals equity. Revenues minus expenses equals (in general) the amount of change in equity after a period closes. There are exceptions though - payment of dividends by a company reduces a company’s equity as will share repurchases. When a company issues stock they take in an asset (usually cash) and their equity increases. Profits increase equity. Losses decrease equity. Debits and credits are hard to grasp, but represent changes in those 5 accounts.

thank you so much. I will make a list and start studying it.The bigger do-it-yourself brokers like Ameritrade, Schwab (same company as Ameritrade - just not yet consolidated), E*Trade, and Fidelity all have “learning center” links on their websites to all sorts of topics.

Yahoo Finance has a ton of information.

Investopedia dot com is one of the best resources. Search pretty much any term and there will be an article with the definition on it, usually with multiple sub-articles giving different perspectives.

Motley Fool dot com has lots of information, but they work hard to get visitors to buy their paid subscription.

I’m sure that there is an “Investing for Dummies” book. Maybe even a series of topics.

it’s difficult at first, but it won’t take too long to grasp enough to participate in investing.

There are 2 BASIC investments - (1) equities (or shares of stock) and (2) debt (bonds or loans - either as the borrower or the lender). So there are 4 fundamental investing positions - buying or selling equities or debt.

FUNDS package securities into large pools that are sliced up into shares of the entire investment product. Mutual funds were the most pooular type of fund until about 20 years ago. Now exchange traded funds (or ETFs) are the most common type of fund. There are variants of ETFs such as UITs. The difference is mostly the legal organization or administration of the “funds”. Funds are the best place for new investors to get started.

Understanding the types of ACCOUNTS is important. IRAs, 401(k)s, Roth IRAs, Roth 401(k)s, annuities, standard taxable brokerage accounts, etc.

DIVERSIFICATION is one of the most important concepts to be familiar with. DOLLAR COST AVERAGING is important when growing a portfolio of investments. DIVIDEND YIELDS (and dividends per share and earnings per share) and the P/E ratio (price/earnings) are important fundamental concepts with individual stocks. The management fees are important with funds. LONG is the position of owning an investment. SHORT is the opposite (and is VERY risky). When SHORTING you sell a security initially to open a position (and you actually borrow the security from an owner of the security) and then you buy it later to close the position. BULLS (or being bullish) have a positive sentiment and BEARS (or being bearish) have a negative sentiment.

DERIVITIVES are investment vehicles that “derive” their valuation based on other assets. Stock options are a very common type of derivative. Stock options are contracts and have a limited lifespan. Shares of stock on the other hand can exist for many generations of human lives.

Stocks can be publicly traded or privately held. Often privately held stock will be converted (sold) to become publicly traded stocks through IPOs (initial public offerings). SC Johnson (household products), Mars (candy), and Pilot Oil are some of the largest private companies although Pilot is now mostly owned by Berkshire-Hathaway which is a publicly traded company that is controlled by Warren Buffett.

The fundamentals of accounting can be important. Assets, liabilities, and equity account balances are reported on company balance sheets as of a specific point in time. Income statements show a company’s revenues and expenses over a time frame (typically a year, quarter, or a month). The net income or net loss is the bottom line of an income statement and is the difference in those two accounts (revenues minus expenses). There are 5 primary types of “accounts” with accounting. Assets, liabilities, equity, revenue, and expense. There are actually formulas for them. Assets minus liabilities equals equity. Revenues minus expenses equals (in general) the amount of change in equity after a period closes. There are exceptions though - payment of dividends by a company reduces a company’s equity as will share repurchases. When a company issues stock they take in an asset (usually cash) and their equity increases. Profits increase equity. Losses decrease equity. Debits and credits are hard to grasp, but represent changes in those 5 accounts.

Thank you so much!!!Thisis a good post, @Deathandtaxes . Read and learn, go slowly. Investing, as I see it, is long term (it’s a crockpot, not a microwave). I don’t invest if I think I’ll need that money in 4-5 years. I almost never sell. I’ve held some investments over twenty years; I’ve held Apple at least a dozen years. I don’t get concerned about short term movements- I look over long periods. Try not to act on fear. I don’t try to time the market (but I do buy on bad news if something is on sale and I think the bad news will be forgotten in a number of months). I take counsel in others who are smarter than me. Watch your expenses- not just commission at the front end (if you go full service brokerage) but also the continuing fees that some actively managed mutual funds have on an annual basis. Educate yourself.

thank you so much. I will make a list and start studying it.

That’s gonna keep me busy for awhile.

If I am wanting to just get started trading or swing trade something. Where should I start? Just to learn how it works. Nothing major just enough to get my feet wet. I am gonna be studying, so I don’t want to make any big trades without having any clue to what I am doing. But a trade that could net a couple dollars and I can see how that process works…

what do you look for? Indicators? Patterns? Etc? Watch the news? Don’t watch the news… etc.

Thank you. How much money do I need to have to begin? Any suggestions or what you are investing in as far as ETF? And what do you mean by stock splits?I pay more attention to fundamentals of individual companies. There are others in here that pay more attention to technical indicators.

I wouldn’t try to trade much at first. Buy something good and sit on it for a while. Most of the time typical traders will miss out on big moves up if they jump in and out a lot. Letting winners run is a good strategy.

If I was just getting started I would open an account at Schwab, Ameritrade, or E*TRADE. Not at RobinHood, WeBull, or any other new broker going after the younger traders.

I would start with either a broad market ETF like VTI, VOO, QQQ, SPY, DIA, or SMH or a blue chip company like JNJ, XOM, KR, or WMT.

I’d enter a limit order rather than a market order to hopefully get a slightly better price. Just select a buy price limit a few percent below the current share price. And I certainly wouldn’t go all in until things settle down a bit. This week has been a disaster. That is where dollar cost averaging comes into play. Nobody will always buy at the bottom or sell at the top. So you should takes smaller bites every month.

Avoid penny stocks. Don’t get overly excited about stock splits.

Thank you. How much money do I need to have to begin? Any suggestions or what you are investing in as far as ETF? And what do you mean by stock splits?