Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,234

- Likes

- 53,534

Don't trust your family?Have you ever done that? I believe that the bonds purchased via tax refund are mailed out and am a little leery of the security.

Placed two more put, sell limit orders on. Right now day orders to sell MMM, WHR, and AMZN puts. Sold the NFLX 2208916 P 217.5 this morning.

Only an hour to go on the 3x open orders. I’m not going to adjust the prices today. I think that shares will probably be even lower in the morning. I don’t think that the opportunity to sell puts is over. BUT the 9/16 premiums will be eroding quickly.

Or a return to normal?honestly a 75 or 100 BPS scares tf out of me because I don't think the system can handle it. our entire market is built off credit and it will be gone.

BTW, QT ramps up to 95 billion starting Thursday.

Asset prices have risen in accordance to historically low interest rate, so will definitely come down further violently if rates return to normal.Or a return to normal?

Interest Rates, Discount Rate for United States

More and more I'm viewing this as a significant part of the inflation problem.

There might be a buying opportunity to pick up the RR customers. Nucor (NUE) is off 11.3% today. Alcoa (AA) is -10.9%. Cleveland Cliff (CLF) is -8.5%.

Interestingly, CSX is only down -1.05% today. Norfolk (NSC) is off -2.16%.

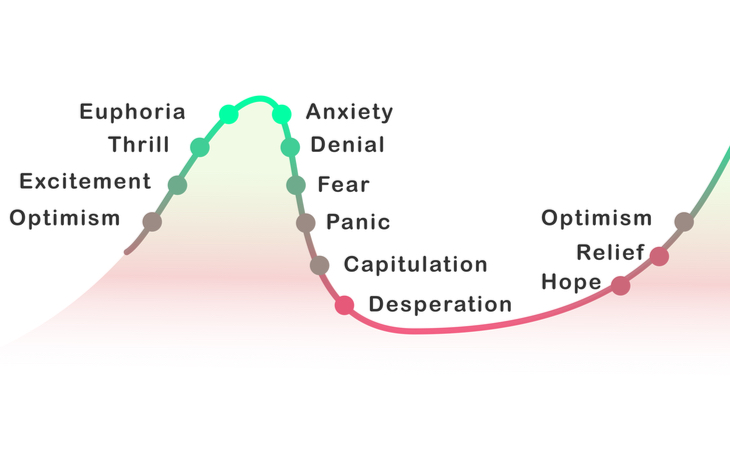

Is it written in stone that the bottom, whenever it comes, has to be a dramatic capitulation with fear, panic selling, etc. Or could it just be a day like yesterday?The fact that it wasn't makes me think we aren't near the low for this most recent push lower, and probably that the June low isn't *the* low on a longer-term basis.

I'd like to see a meaningful push below the low from June, and I think you could put some long-term cash to work there.