superdave1984

Repeat Offender

- Joined

- Aug 14, 2007

- Messages

- 9,377

- Likes

- 6,858

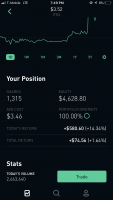

I am new to stocks. Just opened an account with TD Ameritrade. Looking at some dirt cheap stocks, but I have to wonder what happens if that company files for bankruptcy? It has been rumored in the last year or so, but they always get a breath of air. I am not going to spend a ton of money on this, but I am curious about it. I am guessing I will just lose whatever I spent while the CEO of the company cashes another 3 mil bonus check. I have watched this company in steady decline over the last 5 years. Went from $50 or so down to the current stock price of just over $2.