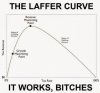

Taxation and revenue: Tax rates are not correlated to federal government revenue. Rates change what an individual pays. Rates do not change what federal government receives in revenue. Revenue average remains relatively constant at about 19% of GDP. The historical trend has been tracked since before WW2. Tax policy has changed frequently over those years. Tax rates have fluctuated dramatically as well. Therefore, one must be careful using phrases like, "deficit increasing tax cuts", or, "revenue neutral". These types of phrases are oxymoronic, at best. They are likely an outright lie used by the political class to manipulate the constituency, at worst.

Those who worry about revenue would have more success by championing aggressive growth in GDP. So far, this is the only historically valid method to increase money in the federal cofer. 19% of 100 Trillion is more than 19% of 20 Trillion. The rate one pays has no effect on how little or how much revenue is collected. GDP grows, currently, regardless of the policies of any particular administration. Both Rs and Ds have been in power during booms and busts. Economic expansion and retraction in America has been largely insulated from central planning by both parties.

For me then the question becomes: if revenue percentage is constant relative to GDP and only increased by increasing GDP and GDP is relatively uncontrollable by politicians, then what are we arguing about? The only control politicians have on tax monies is the spending of the revenue. Neither party and no configuration of DC, save two, has shown any evidence over 70 years that spending is a legitimate concern.