MontyPython

It's Just a Flesh Wound!

- Joined

- Jun 28, 2019

- Messages

- 10,521

- Likes

- 14,044

No. No. No.When you cannot pay down the principle personal debt is a bad thing.

No. No. No.

That's clearly the part you fail to comprehend. There is no paying down a nation's principle.

Need proof? The USA has had a national debt since the founding of our country. And yet here we are, gramps... the greatest national economically on earth.

Checkmate.

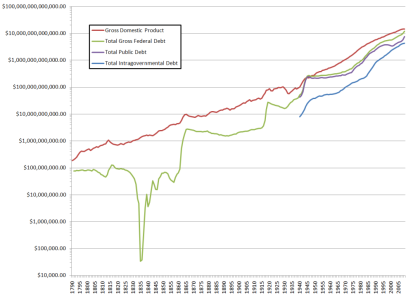

Do us all a favor. Learn how logrithmic graphs work. Maybe, just maybe, this will slowly help you wrap your arms around how things work.

View attachment 661502

question, if we somehow just magically paid of the 34+ trillion right now, without creating any more debt, would our nation be in a better financial/economic situation than we are WITH the 34 trillion of debt?No. No. No.

That's clearly the part you fail to comprehend. There is no paying down a nation's principle.

Need proof? The USA has had a national debt since the founding of our country. And yet here we are, gramps... the greatest national economically on earth.

Checkmate.

Do us all a favor. Learn how logrithmic graphs work. Maybe, just maybe, this will slowly help you wrap your arms around how things work.

View attachment 661502

it also doesn't show a positive correlation. GDP has gone up even when the debt went down. and a large rise in debt was not matched with a large rise in GDP.From 1835 to about 1846 the US was either completely debt free or paid off the amount borrowed yearly. Your chart is crap, the lines crossed during the great depression.

Paying the debt off with what... debt? We ain't got $34trillion sitting in our coffers. Alternatively, pump out trillions in new M1 off the printing press = crippling inflation.why wouldn't repaying it make us better off, if its the same result as the debt disappearing?

and if debt is driving the GDP wouldn't removing it, thru any mechanism, be problematic?

thats why I said magically. maybe the government finds 34 trillion dollars worth of something and sells it off to the various entities that hold our debt. an individual writes a really big check that doesn't bounce, or they died had no one in their will and left it all to pay off the nation's debt.Paying the debt off with what... debt? We ain't got $34trillion sitting in our coffers. Alternatively, pump out trillions in new M1 off the printing press = crippling inflation.

EDIT: We could just conquer Russia and take their Rubles and vodka.

EDIT 2: We could just conquer Hogg and take his Rascal, false teeth and John Denver LPs.

That comparison of household debt to national debt is wrong. To have an apples to apples, you need to compare the national debt to the annual budget in that example. Then the ratio %'s would be pretty close to the same. Slight of hand effort.True, you never said "that word" but you have used synonyms. I've got a lot of them pulled up if you want but I'll just drop one for now.

We already did, after the wall came down and the USSR disappeared. In global banking and investment circles, it's known as "The Rape of Russia."Paying the debt off with what... debt? We ain't got $34trillion sitting in our coffers. Alternatively, pump out trillions in new M1 off the printing press = crippling inflation.

EDIT: We could just conquer Russia and take their Rubles and vodka.

Debt is not inherently bad.thats why I said magically. maybe the government finds 34 trillion dollars worth of something and sells it off to the various entities that hold our debt. an individual writes a really big check that doesn't bounce, or they died had no one in their will and left it all to pay off the nation's debt.

if we would be better off without the debt, how can you say it is not a problem? seems like if we are better off without it, there is something wrong/bad/problematic with it.

Debt is not inherently bad.

Look at it through this prism:

The government can (or did) borrow money (i.e. sold bonds) at stupid low interest rates (e.g. 3%).

If the return on this investment is greater than 3%, the debt has a positive return to our nation.

Consider the federal budget a pool of money. The origin of that pool water comes from many sources including debt issued. When the government loans money to me or you or another business owner (i.e. via fed backed SBA loans) the return on that money back to the government in the form of new taxes pays for the program and then some. Most individuals can earn waaaay more return than the 3% they gotta pay on a loan.

It's in this and other ways that our debt is a good thing.

Correct. It *backs* the money so it's on the hook for it.Holy crap Turbo, the SBA doesn't loan money it guarantees the loans from private lenders. The government doesn't get a return on those loans it can only lose our tax dollars on them. I bet you thought the VA actually loaned veterans money to buy houses.