C-south

Well-Known Member

- Joined

- Sep 15, 2018

- Messages

- 34,332

- Likes

- 59,864

Mainly because Republicans make a big deal about it during Dem administrations but act like it not a problem under their own.

Is Amazon paying its fair share?

Amazon in Its Prime: Doubles Profits, Pays $0 in Federal Income Taxes

Agree. As long as everyone keeps feeding at the trough, mostly corrupt politicians and Big Business, it will never get reduced.Both sides do that Carlos. You and I both know neither side really cares. You and I do, and many others on this board, but at the end of the day it’s a convenient weapon/talking point for political opponents to use against each other. This thing is over with. The debt will continue to climb regardless of tax cuts/increases, gdp growth, spending cuts (never happens), etc. They (in DC) simply don’t care.

What is their fair share? Did their stockholders pay income taxes, employees, did amazon not pay their employee taxes?

I don't know. It was a philosophical question for the board.

I'm solid middle class and wrote a check this year for federal income. Amazon didn't. Just wanted to see what everyone thought about this.

Corporations should get voting rights if they are going to pay income tax.Corporations should pay income tax. How's that?

It boggles my mind when people cry about the Citizens United ruling and argue that corporations are not people and are not protected by the first amendment yet want them to pay income taxes.

The socialist left will never understand thatLiterally impossible.

not collecting money doesn't equal spending money.

we collect 50 trillion dollars and spend 51.1455 trillion and we will still add 1.455 trillion to the deficit.

WE HAVE A SPENDING PROBLEM.

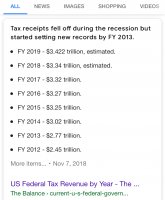

I am willing to bet that we bring in a similar amount of money for 2018 taxes as we did in 2017. willing to bet in 19 we bring in more than we did in 17.

Literally impossible.

not collecting money doesn't equal spending money.

we collect 50 trillion dollars and spend 51.1455 trillion and we will still add 1.455 trillion to the deficit.

WE HAVE A SPENDING PROBLEM.

I am willing to bet that we bring in a similar amount of money for 2018 taxes as we did in 2017. willing to bet in 19 we bring in more than we did in 17.

Then cut the damn spending limits! Right now!“CBO estimates the tax cut, and associated borrowing costs, will add $2.3 trillion to federal deficits over the period 2018 to 2028. When the added growth from the tax cut is included in the calculation, the deficit increase falls to $1.9 trillion over the same period.”

“All current data point to a rapidly deteriorating fiscal outlook, which runs directly counter to the contention that the tax cut is budget neutral. From 2013 to 2017, federal revenues increased at an average annual rate of 4.5 percent. In 2018, the federal government took in $3.329 trillion in receipts, or just 0.4 percent more than in 2017. In the first quarter of 2019, federal receipts are still flat, with no revenue growth over the first quarter of 2018.”

Then cut the damn spending limits! Right now!

That’s what anybody on this board has to do in balancing their home budget. That’s what company’s have to do. Only the damn government can say “you people must give us more money to pay for our expenses” and get away with it!

Gov did not cut revenue. We have pointed that fallacy out time after time. It’s a false narrative, we have a spending problem not a revenue problem. And nice deflection from the point, every other entity has to live within their means.... except .gov.Government isn’t a company. And never has been since the conscription of civil service by the Roman Empire. Government has increased spends and cut revenue the last two years. What did y’all expect to happen.