Majors

Well-Known Member

- Joined

- Oct 7, 2020

- Messages

- 23,330

- Likes

- 38,392

What did she buy that at? If I saw right she bought 50-$150 calls for a Jan of 2026? That's a stupid trade unless you know something. imho.

Aren't they abandoning weight loss drugs? What do you think they are good at?

while I lost some last time I tried, GOOG has dipped quite a bit and I may buy into this trade again today.

View attachment 724813

Also, Semaglutide was not included in the FY2025 guidance post Q1 and yet the guidance was raised by 56% to $2.3B-$2.4B v $1.0B estimate.

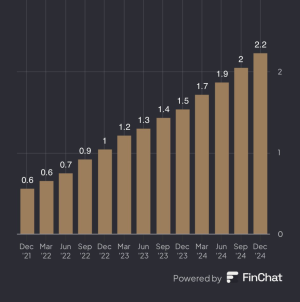

Check out the growth:

View attachment 724814

CEO says his goal is 10 million subs by 2028.

That stock is a crazy ride. I made some and was burned some on it in 2024 a few times.I shorted SMCI 3/8/25 puts. So I’ll be assigned SMCI shares after the Friday close unless there’s a ferocious rally. Off 13% today and another 2% in after hours, so I’m screwed on that trade. For now. I don’t expect a quick rally since there’s an allegation of cheating on trade regulations. Those things take a while to unwind - even if there’s no wrong doing proven. It was a $55 stock less than a week ago and is $20 less right now.

That stock is a crazy ride. I made some and was burned some on it in 2024 a few times.

looks like semis may have found a near term bottom.

They’re accusing US of dumping? Pot - meet kettle. That regime (dictatorship) needs to vanish. Liars. Cheaters. Thieves. Soulless scum.

Maybe this is really about reworking the trade deal to keep China steel from being rebranded. I dunno. I agree with you about rick aversion with Trump as president. I'm having a hard time keeping my money in the market for longer than a couple of days because I get too nervous.

Joint session address at 9PM. Markets up right now. Lets see what he says.Trump knows that market performance will need to be doing well when the mid-term elections are ramping up. So he’s not necessarily going to be market friendly for another year. DOGE is supposed to sunset in about 16 months. I think this is the time frame he’s on.

The current policies are necessary to get the country on track from a bottom line perspective. Unfortunately for him and the Rs, it might take more time than they have to get to a good place. Even if the Ds believe in the policies we’re moving toward, their tact will be to drag it out by resisting and blocking and then taking credit after Trump is out and the LT economic benefits materialize.