You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All things STOCKS

- Thread starter bignewt

- Start date

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 5,005

- Likes

- 8,959

Well, it was the last two. My investments are super boring and since I have some long duration bonds, the bonds were moving. But history suggests there will months like that in the future.

A better question, I guess, is why did you think it was a meh market? Look at it for real. Look at velovols chart about the 57 day periods

A better question, I guess, is why did you think it was a meh market? Look at it for real. Look at velovols chart about the 57 day periods

Majors

Well-Known Member

- Joined

- Oct 7, 2020

- Messages

- 22,860

- Likes

- 37,774

That is true. I knew things improved, but didn’t know it turned that sharply in 57 day. Let me study.Well, it was the last two. My investments are super boring and since I have some long duration bonds, the bonds were moving. But history suggests there will months like that in the future.

A better question, I guess, is why did you think it was a meh market? Look at it for real. Look at velovols chart about the 57 day periods

Yeah, my real accounts may be back up by that amount. I haven’t even looked at them since spring.

As mentioned before, my thoughts on here are just the fun money short term darting and dancing. Entertainment

I’m sour on Amazon, but the general jest of the old FAANG plus Microsoft is the core closest to my heart. The USA cannot function without Apple and Microsoft. Ad based companies will come back…I like Google. Meta…who knows? Netflix has so much competition.look for pharmaceutical phases about to be upgraded....the lower the better. But if you're like me, I just keep buying Amazon and Google

In general though, the new version of Big Tech is my # 1 favorite. Not sure if Cisco and Intel can ever recover. But, NVDA is a boss.

Last edited:

Majors

Well-Known Member

- Joined

- Oct 7, 2020

- Messages

- 22,860

- Likes

- 37,774

I’m sour on Amazon, but the general jest of the old FAANG plus Microsoft is the core closest to my heart. The USA can not function without Apple and Microsoft. Ad based companies will come back…I like Google. Meta…who knows?Netflix has so much competition.

In general though, the new version of Big Tech is my # 1 favorite. Not sue if Cisco and Intel can ever recover. But, NVDA is a boss.

Jeff Bezos potential return could turn Amazon up in 2023. I’m on energy now and even bought a little Disney a few weeks ago

Also watching chips, intel mainly

mrorange211

Well-Known Member

- Joined

- Dec 9, 2011

- Messages

- 6,620

- Likes

- 7,512

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,387

- Likes

- 53,669

I’m sour on Amazon, but the general jest of the old FAANG plus Microsoft is the core closest to my heart. The USA can not function without Apple and Microsoft. Ad based companies will come back…I like Google. Meta…who knows?Netflix has so much competition.

In general though, the new version of Big Tech is my # 1 favorite. Not sue if Cisco and Intel can ever recover. But, NVDA is a boss.

Netflix seems to be handling their competition. They still have huge expense from acquiring content that is hammering their bottom line, but they are about to begin growing the new revenue stream from selling ads. The crack down on sharing passwords is also about to kick off. They said that they will no longer report subscriber counts which is a good idea as many accounts will be cancelling without being able to share them.

Much of the risk in owning NFLX shares has been reduced with the pull back from $700 to $165 (and now around $310).

NVDA (and AMD) are fabless and are dependent on 3rd parties such as TSM and the CCP. Intel and TXN are integrated device manufacturers. INTC is building a huge factory in Ohio.

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 5,005

- Likes

- 8,959

mrorange211

Well-Known Member

- Joined

- Dec 9, 2011

- Messages

- 6,620

- Likes

- 7,512

Costco Stock Results

Costco Wholesale announces its fiscal first-quarter results Thursday after the market close. The wholesaler has reported positive earnings and revenue growth going all the way back to Q1 2018.

However, the company's sales growth has slowed in recent months. Costco reported $19.17 billion in sales for November, up 5.7% year over year. That's lower than the 7.7% increase reported in October and 10.1% growth announced in September. And e-commerce sales fell 10.1% from October to November.

Expectations: Wall Street predicted the wholesaler's earnings would climb 5% to $3.12 per share. And sales were seen growing 16% to $58.36 billion, according to the FactSet consensus. Lower Sharp consensus estimates had revenue growing 9% to $54.86 billion.

Results: Costco's earnings rose 3% to $3.07 per share on 8% revenue growth to $53.44 billion.

Same store sales rose 6.6% year-over-year but e-commerce sales fell 3.7% for the period.

Costco Wholesale announces its fiscal first-quarter results Thursday after the market close. The wholesaler has reported positive earnings and revenue growth going all the way back to Q1 2018.

However, the company's sales growth has slowed in recent months. Costco reported $19.17 billion in sales for November, up 5.7% year over year. That's lower than the 7.7% increase reported in October and 10.1% growth announced in September. And e-commerce sales fell 10.1% from October to November.

Expectations: Wall Street predicted the wholesaler's earnings would climb 5% to $3.12 per share. And sales were seen growing 16% to $58.36 billion, according to the FactSet consensus. Lower Sharp consensus estimates had revenue growing 9% to $54.86 billion.

Results: Costco's earnings rose 3% to $3.07 per share on 8% revenue growth to $53.44 billion.

Same store sales rose 6.6% year-over-year but e-commerce sales fell 3.7% for the period.

Costco down $1.39/.28% at 5:15 est.Costco Stock Results

Costco Wholesale announces its fiscal first-quarter results Thursday after the market close. The wholesaler has reported positive earnings and revenue growth going all the way back to Q1 2018.

However, the company's sales growth has slowed in recent months. Costco reported $19.17 billion in sales for November, up 5.7% year over year. That's lower than the 7.7% increase reported in October and 10.1% growth announced in September. And e-commerce sales fell 10.1% from October to November.

Expectations: Wall Street predicted the wholesaler's earnings would climb 5% to $3.12 per share. And sales were seen growing 16% to $58.36 billion, according to the FactSet consensus. Lower Sharp consensus estimates had revenue growing 9% to $54.86 billion.

Results: Costco's earnings rose 3% to $3.07 per share on 8% revenue growth to $53.44 billion.

Same store sales rose 6.6% year-over-year but e-commerce sales fell 3.7% for the period.

OTOH, Netflix is producing horrible content. They even take a big star and put them in a terrible movie. Do you have Netflix? I don't know anyone that has Netflix that is not disappointed in their content.Netflix seems to be handling their competition. They still have huge expense from acquiring content that is hammering their bottom line, but they are about to begin growing the new revenue stream from selling ads. The crack down on sharing passwords is also about to kick off. They said that they will no longer report subscriber counts which is a good idea as many accounts will be cancelling without being able to share them.

Much of the risk in owning NFLX shares has been reduced with the pull back from $700 to $165 (and now around $310).

NVDA (and AMD) are fabless and are dependent on 3rd parties such as TSM and the CCP. Intel and TXN are integrated device manufacturers. INTC is building a huge factory in Ohio.

The old stuff is good, sometimes very good.

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 5,005

- Likes

- 8,959

I sure wish they'd build a Costco in the Tri-Cities.

williamson County 260,000 Brentwood, Franklin

Davidson " 700,000 Nashville

Rutherford " 350,000 Murfreesboro

Each of these adjoining counties has a Costco. The other two are on the south side of Nashville. Not sure how that compares to the tri cities these days. We lived in JC 85-87.

Last edited:

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,084

- Likes

- 8,070

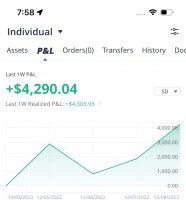

I’ve had a pretty decent week of trading. Just making safer bets, and taking profits early.

View attachment 521990

That is a nice week. I've got the wrong brokers for jumping in and out for couple of hours.

In the old days, we called various forms of that 'day trading'. Then auto-programmed computers took to jumping in and out on every 1% swing. What do you call taking quick profits...'scalping'?

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,084

- Likes

- 8,070

It’s kind of wild but I’ll go in something like Tesla, Spy, etc and throw $50,000 at it, get up half a percent and then take profits.That is a nice week. I've got the wrong brokers for jumping in and out for couple of hours.

In the old days, we called various forms of that 'day trading'. Then auto-programmed computers took to jumping in and out on every 1% swing. What do you call taking quick profits...'scalping'?

Jeff Bezos potential return could turn Amazon up in 2023. I’m on energy now and even bought a little Disney a few weeks ago

Also watching chips, intel mainly

If you bought Disney on the drop, that was a good move. Who dreamed they would fire the CEO and bring back the successful guy. I've got a little of the Vanguard 'Energy for Dummies' VDE. As it drops, trying to decide if we need more.

Chips gotta come back sometime. I'm in a Fidelity semiconductor index fund that is down about 30% for me.

It’s kind of wild but I’ll go in something like Tesla, Spy, etc and throw $50,000 at it, get up half a percent and then take profits.

Yes. I want to do that. Just need another broker. My current ones want the $50k to 'settle' every time which ties up your money. Curious what the kiddo's call that strategy now? Do you always enter in pre-market or early in the day?

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,084

- Likes

- 8,070

So it really just depends. I use WeBull so I can start at 4am. I’ll usually wake up and see how things look, find the play. If Apple is down like .5-.7 I’ll jump in with $100k and hold until it gets back to even. Then I’ll go back to sleep. Sometimes it happens fast, rsi gets hot and I sell, then short it back down .2-.5. My issue is usually losing those gains on some dumb options play, but I’m getting really good at being up a couple hundred or so on a $1,000 0DTE play and running. I think one of my plays today was a $555 gain on a $1,000 buy of 0DTE 398 Spy calls. I start with $1,000 buying them when they’re in the .20-.30 range with the expectation of buying more to average down if it drops or just sell fast if it immediately rises.Yes. I want to do that. Just need another broker. My current ones want the $50k to 'settle' every time which ties up your money. Curious what the kiddo's call that strategy now? Do you always enter in pre-market or early in the day?

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,084

- Likes

- 8,070

Netflix seems to be handling their competition. They still have huge expense from acquiring content that is hammering their bottom line, but they are about to begin growing the new revenue stream from selling ads. The crack down on sharing passwords is also about to kick off. They said that they will no longer report subscriber counts which is a good idea as many accounts will be cancelling without being able to share them.

Much of the risk in owning NFLX shares has been reduced with the pull back from $700 to $165 (and now around $310).

NVDA (and AMD) are fabless and are dependent on 3rd parties such as TSM and the CCP. Intel and TXN are integrated device manufacturers. INTC is building a huge factory in Ohio.

I have been in/out of TSM. Big believer in them. The pandemic has made it a challenge, but they are a hoss in cranking out the chips. With available labor down, just don't know is Americans are willing to work production lines in Ohio or for Texas Instruments. Even with Prez Biden helping pay their salaries, people don't want to work hard for $25/hour or whatever.

Advertisement