What I’m doing is making some options trades. That’s very different from being an options trader. To be an options trader I think that you’ll need to have several computer screens on your desk and you’d also need to be able to stay very focused for hours on end. I’m too old for that.

I’ve made 2 watch lists of stocks and sort them on the percentage change for the current day.

One list is of stocks that I own at least 100 shares of (each options contract is for 100 shares). I exclude stocks that are currently worth less than what I paid for them (personal preference - I want to decide exactly when, if ever, that I sell shares at a loss). I only include on this watch list shares that I don’t mind selling - so I exclude my core, long term holdings. If from a taxable account I also want to avoid taking a big profit on the shares and having to pay the capital gains tax (I prefer using my IRA accounts to avoid taxes on trades of both options and shares - since I’m only selling puts and calls, I won’t have a wasted tax loss inside of an IRA). So I look at the biggest current day percentage gainers from this list as the markets open. I will consider selling call options on the stocks in the list - especially those that have had a crazy jump in today’s price. As long as the stock prices stay high, if I’ve sold the covered calls I get to pocket the “free” proceeds from selling the call options. I’m keeping the expirations near. This Friday, next Friday, or the Friday after that.

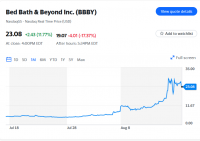

My other watch list (for selling PUTS) is of stocks that I’m considering buying. Sorted on the current day’s percentage once again. So I look at the stocks with the biggest declines in share price. If I see something that I would like to own, I sell the put contract with a strike price even a few percentage points lower than the current price. If the shares rise in price, I won’t own the shares of stock - but I will get to pocket the “free” proceeds from selling the put options. If shares continue to fall, I’ll probably end up being forced to buy the shares, but I will own a bit cheaper than where the shares traded before I sold the put option contract(s).