BigOrangeMojo

The Member in Miss December

- Joined

- Jan 24, 2017

- Messages

- 29,237

- Likes

- 66,345

Again, this is a company that could not see where this industry was going and I am supposed to subsidize their stupidity. I have no problem giving incentives to companies that will provide a return on the investment. I have another problem giving it to a company thay has consistently been outmanuvered and outexecuted by its competitors.

$20B seems like a lot of Capex but again, they haven't properly invested in the past. At some point, you have to play catch up for your prior underinvestment...

If the people who have run Intel the past 10-20 years ran these companies...

Amazon- Would only be an online bookseller

Netflix - Would only be delivering DVDs

Apple - Would only be selling Macs and ipods

Google - Would only be doing search

Intel was a near monopoly with x86 so they haven’t had to evolve as quickly. Their revenue mix is trending away from PC CPUs none-the-less.

Alphabet/Google’s valuation (72%) is actually far more concentrated in advertising/search than INTC’s is in PCs (41%).

Apple’s valuation is 42% iPhone. Watch/TV hardware is 13%. Mac 8%. iPad 6%. Services is the #2 source of revenue (and the valuation) and much of that (approx 20%) is licensing paid to them from Google. App sales is the biggest component of services (about a third of it).

The bottom line is that bottom lines, especially in tech, are highly dependent on the luck of macro economics and uncontrollable market conditions.

You are WAYYY underputting the reasons for Intel's decline. Everyone in the industry saw the shift to mobile, data center, and gaming chips. Everyone except Intel. This isn't bad luck but 10-20 years of strategic incompetence.

While PCs aren't going away as you noted, they will decline and will be purchased in larger numbers by businesses who won't be swayed by branding. Yes, Granny who uses her desktop to log into Facebook might be swayed by Intel's branding, the bulk of OC sales in the future will be made by companies that know Intel is behind the times. We've had this same conversation for years with Intel in the 60s, 50s, 40s and now 30s.

Things may change in the future and the US taxpayer may help finance Intel's path to catch up.

From what I've seen, the narrative for last week's rally is the belief that the Fed will not raise rates much further, and will start easing early next year. Support for this was found in some ambiguous language in the statement on Wednesday.Anybody able to explain this to me?

What exactly is the deal with INTC as a company? Are they simply behind NVDA and AMD in terms of the technology?

I’m completely surprised the DOW is still above 30K with all the financial news pointing downwards? Anybody able to explain this to me?

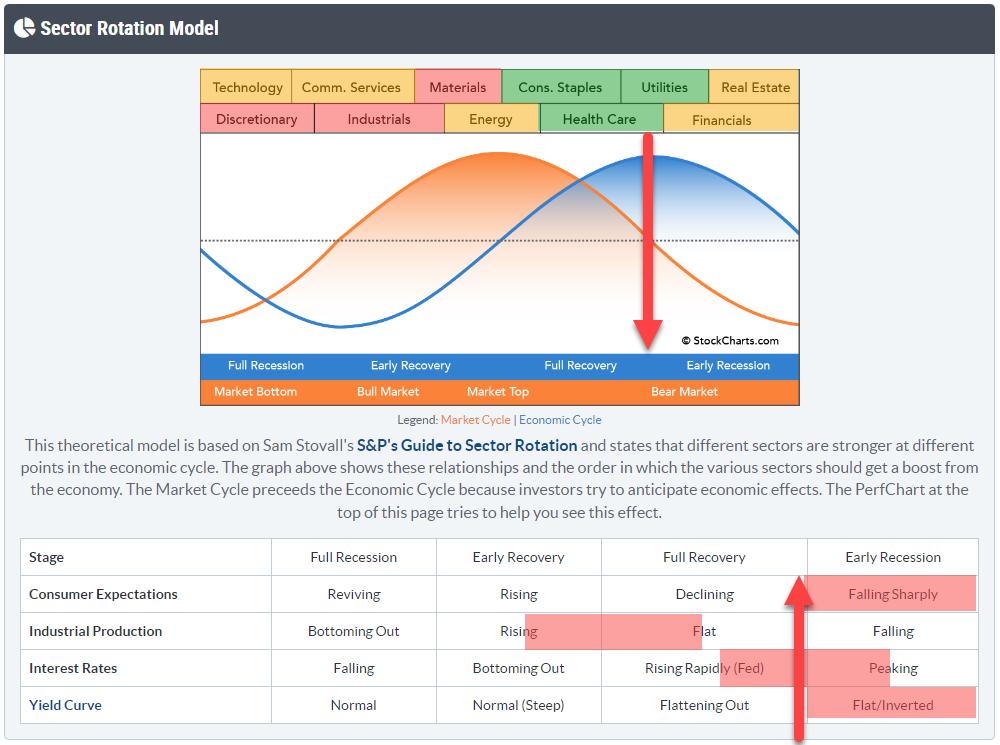

Maybe I'm listening to the wrong people, but the anticipation I keep hearing about is interest rates (Fed loosening), not the bottom of the business cycle.Market (orange) trades ahead of economy (blue). The eternal question is: where are we on this graph? This current red line is one month old and has moved forward (cycle goes left to right). Opinions vary but I think we are near market bottom and recession.

Maybe I'm listening to the wrong people, but the anticipation I keep hearing about is interest rates (Fed loosening), not the bottom of the business cycle.

Worst case scenarios can never be priced in. That is madness. How can you even ask? No individual outcome is ever priced in. Some probability of a worst case scenario (and in fact all scenarios) can be priced in.Peleton (PTON). I’ve never liked it. But it now sells under 1x sales. Below $11/share, up from an $8.22 bottom. Down from a $123

Buy Puts? Or is the likely worst case scenario already priced in?