BigOrangeMojo

The Member in Miss December

- Joined

- Jan 24, 2017

- Messages

- 29,911

- Likes

- 67,727

Unless you are tired of pumping money in. Im about at that point.

It appears as though I picked a bad time to get involved! Glad I decided to start small. Goodness. I've lost almost 20% of my initial investment. Feel bad for some of you guys with more skin in the game.

They said the same thing about the dot-coms in 2000. They said Buffett was a great investor, but a class of companies had come along that he didn't understand and were subject to different methods of valuation. A frequent refrain was that the dot-coms were impervious to higher interest rates because they weren't tapping the debt markets for growth.Wood has been compared to Warren Buffett. If that’s the case then there has been a massive upheaval in security analysis and Benjamin Graham is spinning in his grave. Check out those earnings multiples.

If a stock has dropped 20%, you can buy 125% of the shares today versus yesterday for the same cost.

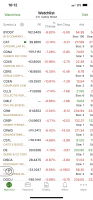

She's not even close. Only the future will tell what kind of investor she really is.Wood has been compared to Warren Buffett. If that’s the case then there has been a massive upheaval in security analysis and Benjamin Graham is spinning in his grave. Check out those earnings multiples.

A lot of people I follow on Twitter are obsessed with her - I would describe these people as trendy or hipsters. All very young as well.She's not even close. Only the future will tell what kind of investor she really is.

She's been a trend person, and probably a trend leader. Has she driven up prices because she keeps getting more to invest? A victim of her success?

I think you always have to be wary of just one year's worth of good performance. She was on the right side of a huge momentum trade that began after the COVID selloff last year. And credit to her - she had liked those names for a number of years and stuck with them after a couple of years of flat performance and getting ripped last March.She's not even close. Only the future will tell what kind of investor she really is.

She's been a trend person, and probably a trend leader. Has she driven up prices because she keeps getting more to invest? A victim of her success?

I know this sounds smug, but I've seen it time and time again. Her biggest fanboys are young people who are new to investing and wouldn't care at all about investing if it wasn't for her incredible performance over the last 8-10 months or so. They don't know much about finance, economics, or markets; they just know that these companies are "cool" and the stocks have gone way up. It's a cool, trendy thing to feel a part of. What I would call the Instagram "motivational speaker finance bro" crowd absolutely adores her too.A lot of people I follow on Twitter are obsessed with her - I would describe these people as trendy or hipsters. All very young as well.

Right, I totally get what you're saying. I am relatively new to the markets - I've watched my 401k for 10 years, but I've only been running my own brokerage account for three years or so.I know this sounds smug, but I've seen it time and time again. Her biggest fanboys are young people who are new to investing and wouldn't care at all about investing if it wasn't for her incredible performance over the last 8-10 months or so. They don't know much about finance, economics, or markets; they just know that these companies are "cool" and the stocks have gone way up. It's a cool, trendy thing to feel a part of. What I would call the Instagram "motivational speaker finance bro" crowd absolutely adores her too.

Her general thesis could be and probably is right, that there are a ton of disruptive companies out there that will change the way we do business. However, it doesn't mean her ETFs are great buys at these levels. Remember, everything the bubbleheads on CNBC said about how the internet was going to change the world was right. It didn't mean that the Nasdaq was a great buy in 1999 or 2000 though. It is really easy to conflate those 2 concepts. Sure, if you bought then and held on until today you would have made a lot of money, but think about the opportunity cost.