nope, Trump was accused a couple weeks ago of crashing the stock market. The left has been wrong on everything...as usual.

the GDP was down but not for bad reasons....consumer spending is strong

It's official: GDP is negative.

www.profstonge.com

It's official: GDP is negative.

And it is glorious.

Last week the Bureau of Economic Analysis reported that GDP for the first 3 months of 2025 turned negative for the first time since 2022.

The kicker is all the pain was caused by a 41% surge of imports front-running tariffs. Which GDP bizarrely counts as negative GDP.

Drop those and actual GDP soared by a blistering 4 and a half percent.

Which is Asia-level.

It actually gets better. Because government spending dropped for the first time since 2022.

My colleague EJ Antoni noted that consumer spending outpaced government spending by 3.2% -- also the best number since 2022.

Control for that drop in government spending and the economy grew by nearly 5 percent on the quarter.

Investment is Booming

So what's driving Trump's boom? Simple: private sector investment.

The mother's milk of prosperity.

BLS said investment skyrocketed on the quarter by 22 percent. Much of it driven, ironically, by the very same tariffs that took the headline number negative.

In other words, foreign -- and domestic -- companies are falling over themselves to move production inside Donald Trump's tariff umbrella.

So going by these numbers, America is re-industrializing at light speed. And the tip of the spear is foreign companies moving production here.

A month ago I put up a video how massive these incoming investments are -- at the time it was $3 trillion. Including $165 billion from Taiwan Semiconductor, $100 billion from Japan’s Softbank, $500 billion from Apple, and $2 trillion combined from Dubai and Saudi Arabia.

That number is now $5 trillion in announced deals -- last week Trump said the real number is $8 trillion and counting.

For perspective, pre-Covid gross private investment in the entire economy was about $4 trillion. Trump's already doubled that, maybe tripled. In 3 months.

Consumers and Inflation

That scale of investment implies an explosion in high-paying jobs; the Taiwan Semiconductor project in Arizona alone is projected to create 40,000 construction jobs.

Multiply that by between 20 and 50 times to get to the trillions we’re talking. And with mass deportations — especially with the scrutiny these projects will have — the overwhelming majority go to Americans.

The one concern on GDP had been consumer spending, with media hyping soft consumer surveys. In another recent video I mentioned how these surveys are questionable since big moves are driven by partisanship -- people who hate Trump say the economy sucks, and people who love Trump say it’s grand.

Well, the Bureau of Economic Analysis just reported consumer spending is on fire, hitting 0.7% on the month -- that's close to 9 percent annualized.

Finally, inflation. Which also reported last week at flat — as in zero inflation. For the second time in Trump's 3 months.

Soaring investment and crashing inflation is just about the sweetest 4 words in economics. So what’s next?

What’s Next

Before Trump took office I figured the economy would be a cagefight between Biden's recession overhang and Trump boosting investment, energy, and cutting regulation.

I did not anticipate how massively Trump's tariffs would boost investment -- 5-plus trillion of investment is monster numbers.

As for the immediate future, all those front-run imports will likley show up next quarter as consumption or investment, delivering a big, beautiful GDP number.

Meanwhile those monster investment numbers will start taking pole position, swamping any hits to paper GDP from government layoffs and mass deportations.

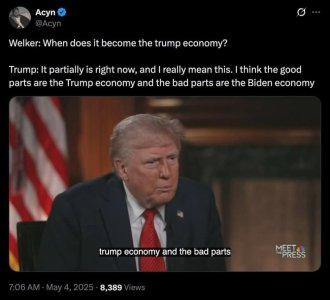

Last week a reporter asked Trump about the negative GDP print and he said "be patient, the boom is coming.”

So far that’s exactly what’s happening. And if Congress gets its butt in gear on deregulation and tax cuts it can go much faster.