Maybe the problem is not tarriffs but Japan builds better quality cars more efficiently than GM. Add to this, the unions are a dead albatross around the neck of US companies making them less profitable while causing higher prices for consumers. The unions basically killed steel production in the US making Japan a world leader in steel.

Unions make it extremely difficult for American companies compete globally.

from GROK:

Resistance to Modernization:

The USW has occasionally resisted plant closures or production shifts to EAFs, fearing job losses. For example, U.S. Steel canceled modernization plans for Mon Valley Works due to permitting issues, and Great Lakes Works was scaled back, impacting union jobs. The USW’s push to maintain blast furnaces has preserved some jobs but may delay transitions to more competitive technologies

Jmacvols1: Longshoreman threaten to strike because they did not want companies to modernize loading/unloading with robotics causing loss of union jobs.

Advocacy for Protectionism:

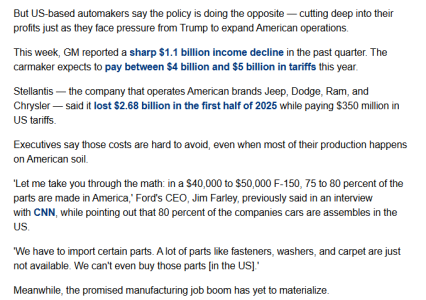

The USW has been a vocal proponent of tariffs, such as the 25% steel tariffs imposed in 2018 under Section 232 and raised to 50% in 2025 under President Trump. These tariffs aim to protect domestic production but can raise costs for industries like automotive, potentially reducing demand for U.S. steel if manufacturers pass costs to consumers.

Jmacvols: Automobile manufactors moved south to avoid Unions along with steel mills....

from GROK: (my emphasis)

Context: Steel Industry and Union Dynamics

The U.S. steel industry has faced significant challenges since its peak in the mid-20th century, with production dropping from 111.4 million tons in 1973 to 70 million tons by 1984 due to global competition, technological shifts, and other factors. A key trend has been the transition from traditional, unionized blast furnace mills—often located in the Rust Belt (e.g., Pennsylvania, Ohio, Indiana)—to modern electric arc furnaces (EAFs) or “mini-mills,” which are

more efficient, use scrap metal, and require fewer workers.

These mini-mills are often built in regions with less union presence, such as the southern U.S., where labor laws and economic incentives are more favorable to non-unionized operations

The United Steelworkers (USW), formed in 1942, has historically been a powerful force in the steel industry, securing high wages and benefits but also facing criticism for increasing labor costs and resisting modernization efforts that could reduce jobs. The decline in unionized steel jobs—from 340,000 at U.S. Steel’s peak in 1943 to 83,600 industry-wide by 2025—reflects closures of integrated mills and the rise of EAFs, which are often

non-unionized

Modernized Steel Mills in the Southern U.S.

Several modernized steel mills, particularly EAF-based mini-mills, have opened or expanded in the southern U.S. in recent decades. These facilities align with the trend toward cost-efficient, technologically advanced steel production. Here are key examples and their relation to unions:

- Big River Steel (Osceola, Arkansas):

- Overview: Big River Steel, acquired by U.S. Steel in 2020, operates one of the most advanced EAF mills in North America, with a capacity of 3.3 million tons annually. It produces high-quality steel for automotive and other industries, using cutting-edge technology like thin-slab casting and continuous galvanizing.

- Union Status: Big River Steel is explicitly non-unionized, a point of contention for the USW. The union has expressed concerns that U.S. Steel’s acquisition of Big River could shift production away from unionized blast furnace mills in the Rust Belt (e.g., Mon Valley, Gary Works) to non-union facilities like Big River. In a 2022 statement, former USW President Tom Conway warned that Big River’s expansion could mark “the beginning of the end” for union-run mills.

- Rationale for Location: Arkansas offers lower labor costs, business-friendly policies (e.g., tax incentives), and weaker union protections compared to Rust Belt states. The state’s “right-to-work” laws, which prohibit mandatory unionization, make it attractive for companies seeking to avoid union contracts. Big River’s focus on automotive-grade steel also aligns with demand from southern auto plants, many of which are non-unionized (e.g., Toyota, Nissan).

- Nucor and Steel Dynamics (Southern Facilities):

- Overview: Nucor and Steel Dynamics, two of the largest U.S. steel producers, operate multiple EAF mini-mills in the South, including in Alabama (e.g., Nucor’s Decatur mill), Texas (e.g., Steel Dynamics’ Sinton mill, opened in 2021), and Mississippi. These mills produce steel for construction, automotive, and energy sectors, leveraging scrap-based EAFs for efficiency.

- Union Status: Nucor and Steel Dynamics are predominantly non-unionized. Nucor, for example, has a long-standing anti-union stance, emphasizing flexible workforces and performance-based pay to avoid union contracts. Their southern mills benefit from the region’s anti-union climate, with states like Alabama and Texas having right-to-work laws.

- Rationale for Location: The South offers proximity to growing markets (e.g., automotive and energy), lower energy costs (crucial for EAFs), and state incentives. Avoiding unionized labor reduces costs, as unionized mills often have higher wages (e.g., USW-negotiated rates above $30/hour) and stricter work rules.

- Fairfield Works (Fairfield, Alabama):

- Overview: U.S. Steel’s Fairfield Works operates an EAF with a capacity of 1.6 million tons, producing flat-rolled steel for automotive and appliance markets. It’s a modernized facility compared to older Rust Belt mills.

- Union Status: Unlike Big River, Fairfield Works is unionized under the USW, reflecting U.S. Steel’s historical union presence. However, its EAF operations require fewer workers than traditional blast furnaces, reducing union leverage.

- Rationale for Location: Alabama’s business-friendly environment and proximity to southern auto plants (e.g., Mercedes-Benz, Honda) make Fairfield attractive, though union presence suggests it’s less about avoiding unions than leveraging modernization and market access.

- Other Southern Mills:

- Commercial Metals Company (CMC) operates EAF mini-mills in Alabama, South Carolina, and Texas, all non-unionized, focusing on rebar and construction steel.

- 72 Steel (New York, but with Southern Context): A proposed EAF mill in New York, with ties to Chinese investors, aims to produce 3 million tons annually. While not in the South, it reflects the trend of new EAFs avoiding unionized regions, though it’s not explicitly stated as non-union.

Evidence for Union Avoidance

The claim that modernized steel mills are opening in the South to avoid unions is supported by several factors:

- Right-to-Work Laws: Southern states like Arkansas, Alabama, Texas, and Mississippi have right-to-work laws, which weaken union organizing by allowing workers to opt out of union dues. This creates a less union-friendly environment compared to Rust Belt states like Pennsylvania or Ohio.

- Non-Unionized Mills: Big River Steel and Nucor’s southern facilities are explicitly non-unionized, and their locations in the South align with cost-saving strategies. The USW has voiced concerns that U.S. Steel’s shift toward EAFs like Big River threatens unionized mills.

- Labor Cost Savings: EAF mini-mills require fewer workers (e.g., 0.5–1.5 man-hours per ton of steel vs. 10.1 in 1980 for traditional mills), reducing the need for large, unionized workforces. Non-union mills often offer lower wages or flexible work rules, as seen with Nucor’s model.

- Historical Precedent: In the 1980s, U.S. Steel’s South Works in Chicago faced closure partly due to union resistance to concessions on pay and work rules, while newer, non-union mini-mills gained ground. This suggests a pattern of favoring non-union regions for new investments.

==================================================

Time to OUTLAW unions.

Unions need tarriffs on foreign companies to be able to compete causing consumers to pay much higher prices. IIRC several years ago cars could be made in India sold in the US for less than 10K....almost disposible cars. But massive tarriffs had to be put on them to protect unionized US car makers thereby making US consumers pay more to keep the unions wealthy..