Where does our money go? Straight down the drain. Yes I have beat this over the head, but I figure people would appreciate this information more today than other days.

Social Security: 1,102 Billion (SS taxes only cover 949 billion, the rest is paid out of the SS pot)

Medicare: 679 billion (medicare taxes only cover 289 of this, the rest comes out of general taxes)

Medicaid: 418 billion

"welfare" Unemployment Comp, Child Nutrition, Supplemental Security Income, Student Loans, retirement programs (these are considered Mandatory): 642 billion

Interest on Debt: 479 billion

Military Spending: 989 billion (this includes more than the DoD (576 billion) (VA, and most of the Alphabet Agencies that "protect us")) *after the first 325 billion, we are in debt.

And then you get about 437 billion in other spending that we can straight up not afford.

All told its 4,746 Billion dollars (4.746 Trillion) we only bring in 3.645 Trillion. 1,101 Trillion dollar deficit

Revenue: Income Tax: ~50% 1.824 Trillion

SS, Medicare and other payroll: ~36% 1.295 Trillion (compare this number to the money spent above)

Corporate Tax: ~7% 255 Billion

Other earnings: ~8% just over 260 Billion

So seeing where we are making money lets look at popular ideas:

TAX MOAAARRRRR!!!!! Especially those evil corporations. We would need to increase our corporate tax rate 6x to cover the deficit.

Well we already have one of the highest corporate rates in the world, and highest among developed nations at 39%

FACT CHECK: Does The U.S. Have The Highest Corporate Tax Rate In The World?

So we would need a tax rate at around 234% to cover the deficit. Quiet impossible at least twice over.

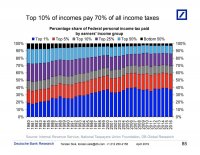

Well maybe we just tax the rich:

Summary of the Latest Federal Income Tax Data, 2017 Update

They (top 1%) pay about 600 billion of the total 1.4 billion. so we would just need to increase their tax rate 3x to cover the deficit. Average tax rate now of 27% (what they actually paid not the rates) so they would need to be 81% to pay the deficit. so even the 70% outrageous tax thrown around wouldn't be enough. I doubt we are keeping the rich people here at that tax rate.

Everyone shares the burden maybe? 14.34% effective tax rate across

us all would need to be right around 27% averaged tax rate to cover the deficit. So the "average" American would need to pay a tax of the top 1% to cover the deficit. I doubt that sells very well at all.

We don't have an income problem, we brought in 200 billion more, with tax cuts, in 2018 than we did in 2017.

We have a SPENDING problem. we SPEND too much. We can not tax our way out of this mess. We have to cut spending.

If we cut EVERYTHING by 30% we could cover it. *if we actually keep the government from increasing spending in the future beyond rate of tax income increase*

Maybe 20% cut, and increase taxes to cover the rest (~18% average tax rate)

Maybe 10% cut, and increase taxes to ~22% average tax rate