BigOrangeMojo

The Member in Miss December

- Joined

- Jan 24, 2017

- Messages

- 29,864

- Likes

- 67,588

You know about this seafood tower life??

View attachment 284729

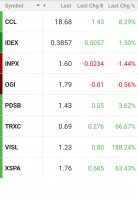

I've never bought a Seafood Tower before (The CEO of wife's Company was in town a few months back and 4 of us devoured the seafood tower at Flemings. That was awesome.) Maybe I will do that if BLMN gets up to $20 (Bloomin owns Flemings).