Thanks for all the info, I will check out your suggestions. I am thinking of investing in the companies that control the 401k's instead as far as those go. I watched some vids on using the Robinhood app, seems convenient with money coming out of my account automatically every month.BTW, 401(k)s don't all have to be full of fees. Bad ones are and ones with employers taking advantage of employees are.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

All things STOCKS

- Thread starter bignewt

- Start date

Big Gucci Sosa

Sniper Gang.

- Joined

- Feb 4, 2015

- Messages

- 33,976

- Likes

- 87,203

Webull or tda are betterThanks for all the info, I will check out your suggestions. I am thinking of investing in the companies that control the 401k's instead as far as those go. I watched some vids on using the Robinhood app, seems convenient with money coming out of my account automatically every month.

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,792

- Likes

- 54,106

Thanks for all the info, I will check out your suggestions. I am thinking of investing in the companies that control the 401k's instead as far as those go. I watched some vids on using the Robinhood app, seems convenient with money coming out of my account automatically every month.

I'd think that Robinhood and similar companies might have high fees. But for many people it's a convenient way to slowly, seamlessly set aside small amounts of savings without much effort. Saving is a discipline. Just cutting $10/day out of spending and setting it aside can be enough to buy a decent used car every couple of years.

Big Gucci Sosa

Sniper Gang.

- Joined

- Feb 4, 2015

- Messages

- 33,976

- Likes

- 87,203

I thought Robinhood was free? Obviously I have a lot to learn, there will be some trial and error for sure.I'd think that Robinhood and similar companies might have high fees. But for many people it's a convenient way to slowly, seamlessly set aside small amounts of savings without much effort. Saving is a discipline. Just cutting $10/day out of spending and setting it aside can be enough to buy a decent used car every couple of years.

Big Gucci Sosa

Sniper Gang.

- Joined

- Feb 4, 2015

- Messages

- 33,976

- Likes

- 87,203

Google $PPA it’s a defense sector ETF. Invesco Aerospace & Defense ETF (PPA) Stock Price, Quote, History & News - Yahoo FinanceI don't know what PPA is. I don't know how you even find the companies you are interested in on the stock market

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,792

- Likes

- 54,106

I thought Robinhood was free? Obviously I have a lot to learn, there will be some trial and error for sure.

There may not be an explicit fee charged, but if they limit investment choices to just a few options, they're likely funds with management fees that are higher than similar funds.

They might also make their money by having lower incentives like rebates for card users. There are costs in their business model somewhere.

Not a direct competitor with Robinhood, but Vanguard offers very efficient funds.

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,097

- Likes

- 8,114

lmoore944

Well-Known Member

- Joined

- Oct 6, 2010

- Messages

- 886

- Likes

- 704

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,097

- Likes

- 8,114

Big Gucci Sosa

Sniper Gang.

- Joined

- Feb 4, 2015

- Messages

- 33,976

- Likes

- 87,203

TheColdVolTruth

Well-Known Member

- Joined

- Oct 23, 2013

- Messages

- 1,752

- Likes

- 1,603

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,792

- Likes

- 54,106

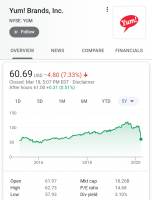

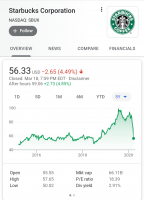

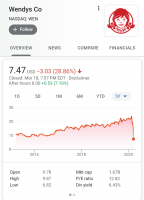

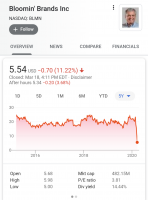

Any thoughts on a beaten down restaurant stock. I'm looking at WEN, SBUX, YUM, AND BLMN. Five year charts attached.

View attachment 267170View attachment 267171View attachment 267172View attachment 267173

The well capitalized chains will come back stronger as a lot of the small, independants and debt ridden chains won't survive. Without looking at their balance sheets for the debt load of each, I kind of like them in the order as listed. (1) YUM sells a lot of Taco Bell through those drive up windows. Although (2) Starbucks is larger, those $4 coffee drinks seem like something that people could do without. Also, Panera is now selling a monthly coffee subscription plan that seems like a direct shot at SBUX. (3) Wendy's has the drive up windows, but they've been passed around so much their balance sheet might not be ideal. They've had combinations with Tim Horton's and Arby's and maybe another brand. I would think that the private equity firm(s) or whoever has been behind their incarnations has most likely stripped out cash and loaded WEN up with debt. (4) BLMN is smallish and would have curbside rather than drive through like the other 3. I also think of their brands as dining room oriented, their revenue will be taking a huge hit. Check the debt on the balance sheets.

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,097

- Likes

- 8,114

I was down nearly $3k on a bio yesterday. Sold, spread the money out a little bit, ended the day up $7k. If you know something else is going to run, cut your losses and buy back later.When is it reasonable to take losses to buy other things. I’m thinking about taking my loss in a biotech and having cash for BAs next dump

VolAllen

Well-Known Member

- Joined

- Mar 14, 2014

- Messages

- 7,097

- Likes

- 8,114

lmoore944

Well-Known Member

- Joined

- Oct 6, 2010

- Messages

- 886

- Likes

- 704

I found a wealth of knowledge on investopedia, I will immerse myself in it and take advantage of every piece of information they have to offer. Maybe in the next month or two I will feel good about making a move. Still open to any advice any of you experienced investors want to give and I will follow this thread daily.There may not be an explicit fee charged, but if they limit investment choices to just a few options, they're likely funds with management fees that are higher than similar funds.

They might also make their money by having lower incentives like rebates for card users. There are costs in their business model somewhere.

Not a direct competitor with Robinhood, but Vanguard offers very efficient funds.

Thunder Good-Oil

Well-Known Member

- Joined

- Dec 2, 2011

- Messages

- 50,792

- Likes

- 54,106

I found a wealth of knowledge on investopedia, I will immerse myself in it and take advantage of every piece of information they have to offer. Maybe in the next month or two I will feel good about making a move. Still open to any advice any of you experienced investors want to give and I will follow this thread daily.

A very good place to start investing in equities would be to buy shares of: Vanguard Total Stock Market Index Fund ETF (VTI) which are under $120/share right now. You don't have to open an account at Vanguard in order to purchase shares in that Exchange Traded Fund, you can buy them through Schwab or other brokers as well.

Don't worry, in fact ignore, how many shares you will own. $1/share investments might look attractive because you'd own a lot of shares, but it is totally irrelevant. Nowadays you can even buy fractions of shares on some trading platforms. The share price x the number of shares issued equals the value of a company. A company could have under a million shares issued or more than a billion. Read about "market capitalization" on investopedia.

Ernest T. Vol

It's me...Ernest T.

- Joined

- Sep 17, 2013

- Messages

- 11,758

- Likes

- 23,106

Big Gucci Sosa

Sniper Gang.

- Joined

- Feb 4, 2015

- Messages

- 33,976

- Likes

- 87,203

Ernest T. Vol

It's me...Ernest T.

- Joined

- Sep 17, 2013

- Messages

- 11,758

- Likes

- 23,106

TheColdVolTruth

Well-Known Member

- Joined

- Oct 23, 2013

- Messages

- 1,752

- Likes

- 1,603

The well capitalized chains will come back stronger as a lot of the small, independants and debt ridden chains won't survive. Without looking at their balance sheets for the debt load of each, I kind of like them in the order as listed. (1) YUM sells a lot of Taco Bell through those drive up windows. Although (2) Starbucks is larger, those $4 coffee drinks seem like something that people could do without. Also, Panera is now selling a monthly coffee subscription plan that seems like a direct shot at SBUX. (3) Wendy's has the drive up windows, but they've been passed around so much their balance sheet might not be ideal. They've had combinations with Tim Horton's and Arby's and maybe another brand. I would think that the private equity firm(s) or whoever has been behind their incarnations has most likely stripped out cash and loaded WEN up with debt. (4) BLMN is smallish and would have curbside rather than drive through like the other 3. I also think of their brands as dining room oriented, their revenue will be taking a huge hit. Check the debt on the balance sheets.

I started a position in YUM and BLMN today with my profits from OILD. Of course WEN spikes over 40%. I plan to continue to add if they go lower. I think these will bounce back long before the travel industry.

Advertisement