TheDeeble

Guy on the Couch

- Joined

- May 6, 2007

- Messages

- 9,187

- Likes

- 7,450

over the next 75 years.SS and Medicare are underfunded 175 trillion

Analyst Warns Social Security, Medicare Underfunded By $175.3 Trillion

Treasury Sec. Says Nation's Path Is 'not sustainable and must ultimately change'scnr.com

Medicare and Social Security face $175 trillion shortfall, risking future generations

Medicare and Social Security are in big trouble as it is now underfunded by a staggering $175 trillion, according to a new report from the Treasury Department.fox28savannah.com

I'll bet you a billion VN bucks that that cut doesn't happen. I think it far more likely that they remove the cap on SSA earnings and tax you on every nickel you earn for it.Your household owes 1.4 million dollars to clear up that 175 trillion.....pay up.

Many many people think they have a "legal right" to a SS check when they have no legal, contractual or property right to a SS check and they are about to find that out in about 9 years when their check gets slashed and they can do nothing about it.

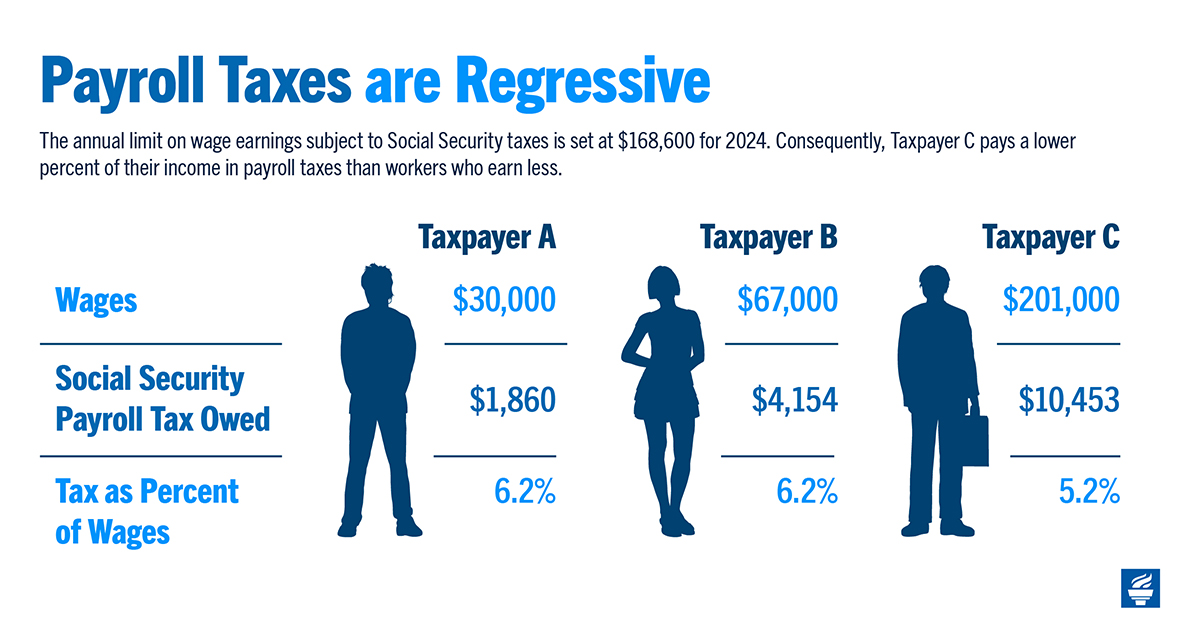

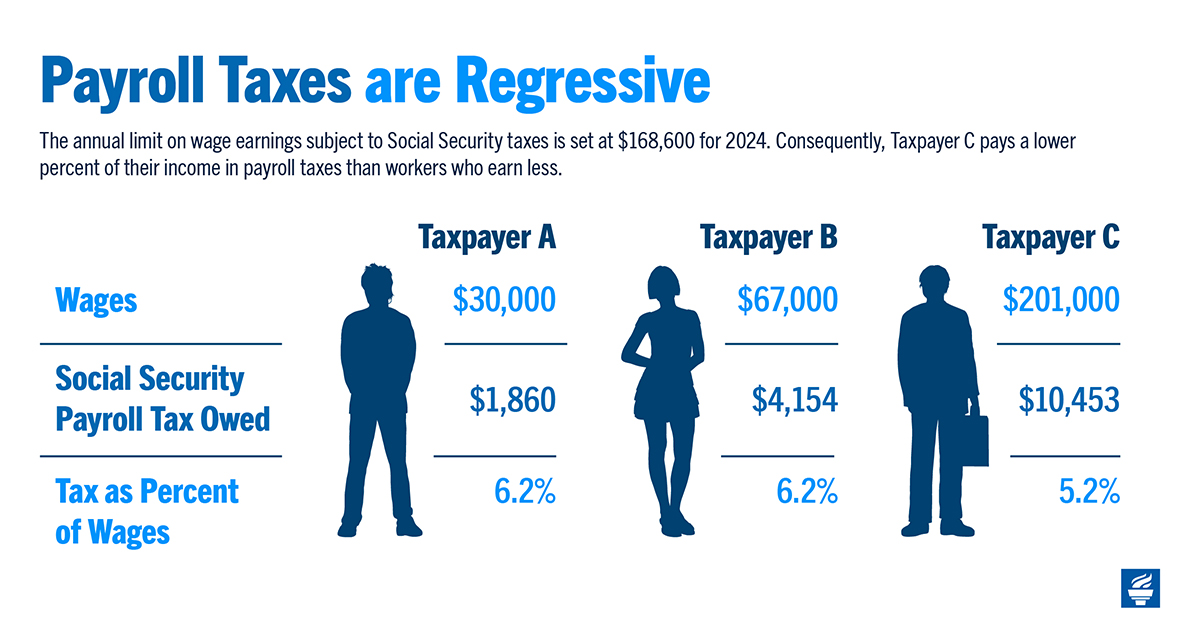

looks like the current cap is 168,600.I'll bet you a billion VN bucks that that cut doesn't happen. I think it far more likely that they remove the cap on SSA earnings and tax you on every nickel you earn for it.

www.pgpf.org

www.pgpf.org

That's a long way from $400k. I'm about done paying into it, so I really don't care, but I want what was taken, with interest. I would have opted out a long time ago with zero repayment, but that was never an option. Now the .gov owes me.looks like the current cap is 168,600.

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.www.pgpf.org

Math:

Ave weekly wage in US = $1200 per week (rounded).

% contributed to SS by employee and employer per paycheck = 12.4%

Ave amount per week going into SS = 150 (rounded)

Amount of money after 47 years of working if 150 per week was put into a very safe investment at 7% = 3M (rounded).

***This assumes a wage which never increases over time.

ave monthly SS check for those retiring at 65 = $1720 (rounded)

ave age of death in US = 73

1720 x (8 years x 12 months) = 165K

The ave earning power the benevolent government stole from the ave american worker = 2,830,000 (rounded)

You are certainly capable of googling to get the info. It's what I did.You're mixing employee and employer contributions, Ace. The average workers pays 6.2 percent into SS--not 12.4.

6.2 percent of 1,200 is about $74.40

The average wage worker in America does not make 1,200 a week. At a 40-hour work week, that would come to $30 an hour. Uh, no.

I doubt most wage workers in America work 47 years before retiring. Less than that.

A "very safe" investment would yield about 5 percent annually, I think, not 7 percent.

You're mixing employee and employer contributions, Ace. The average worker pays a FICA of 7.65%, of which 6.2 percent goes to SS--not 12.4.

6.2 percent of 1,200 is about $74.40

The average wage worker in America does not make 1,200 a week. At a 40-hour work week, that would come to $30 an hour. Uh, no.

I doubt most wage workers in America work 47 years before retiring. Less than that.

A "very safe" investment would yield about 5 percent annually, I think, not 7 percent.

It's true that a lot of people pay money into Social Security that they don't fully recoup before dying. It's unfortunate, but then taxes are the price we pay for having a relatively well-functioning and cohesive society (even if, owing to the gangster and Russians it's been fraying around the edges).

apology accepted.It's true that a lot of people pay money into Social Security that they don't fully recoup before dying. It's unfortunate, but then taxes are the price we pay for having a relatively well-functioning and cohesive society (even if, owing to the gangster and Russians it's been fraying around the edges).

Not surprised at all that you entangle the gangster and Russia into a social security thread.It's true that a lot of people pay money into Social Security that they don't fully recoup before dying. It's unfortunate, but then taxes are the price we pay for having a relatively well-functioning and cohesive society (even if, owing to the gangster and Russians it's been fraying around the edges).

As someone rapidly approaching SS eligibility, this insolvency stuff makes taking it early tempting.

I don't know the rules, can you take it SS at 62/63 and still work or is there an income cap?