85SugarVol

I prefer the tumult of Liberty

- Joined

- Jan 17, 2010

- Messages

- 27,258

- Likes

- 50,526

You might be on to something. The five year chart looks great...

View attachment 289300

Of course you could also look for stock in a "disinfectant"...

View attachment 289301

Simple. The Federal Government is paying people not to work.

If you could make more in unemployment benefits than you could working, would you go back to work?

The $600 payments need to end, or be greatly reduced. We are out of alignment, and it’s an easy arbitrage play for millions.

Simple. The Federal Government is paying people not to work.

If you could make more in unemployment benefits than you could working, would you go back to work?

The $600 payments need to end, or be greatly reduced. We are out of alignment, and it’s an easy arbitrage play for millions.

When I was asking to make sense of all of this, I was hoping someone would relate the $100 billion paid in unemployment to the rising stock markets...Simple. The Federal Government is paying people not to work.

If you could make more in unemployment benefits than you could working, would you go back to work?

The $600 payments need to end, or be greatly reduced. We are out of alignment, and it’s an easy arbitrage play for millions.

When I was asking to make sense of all of this, I was hoping someone would relate the $100 billion paid to in unemployment to the rising stock markets...

When I was asking to make sense of all of this, I was hoping someone would relate the $100 billion paid to in unemployment to the rising stock markets...

For once I agree with on something. The markets aren't dictating whats going on at all, and I think a lot of it has to do with the billons the feds pumped into the economy to try and keep it from tanking. If there is a second wave I think we see a major collapse unless the feds do it again, but once again I will ask the same question as I did the first time. Where do they get the money?No clue. It's all like a giant Ponzi scheme. IMO, the markets are priced completely out of sync with the realities of Main St. Between FOMO, hype about the Feds willingness to basically do anything to prop up the economy, and the new-wave of former-gamblers - now clueless daytraders further pumping up stocks without any regard to technicals - I think the markets are simply defying gravity... for now.

I'm at a loss as to how this all plays out. Should the Feds cut the $600/mo when it ends July 31st? Should they continue it? Or should they provide $ incentives to go back to work? How much of our kids and grandkids' money are we going to throw at the CV19 beast? We're already at what... $3+ TRILLION.

My guess is we have a vaccine by mid-2021. Until then, maybe we get some therapies to reduce deaths somewhat. Between now and then, I think the markets tank when the 2nd virus wave hits this Fall, and reality sets in that the markets pricing in a "V-recovery" was simply delusional.

Simple. The Federal Government is paying people not to work.

If you could make more in unemployment benefits than you could working, would you go back to work?

The $600 payments need to end, or be greatly reduced. We are out of alignment, and it’s an easy arbitrage play for millions.

Why do you ask these silly azz questions? You're a big boy. You know where it comes from. They just pulled it out of thin air.If there is a second wave I think we see a major collapse unless the feds do it again, but once again I will ask the same question as I did the first time. Where do they get the money?

We have active construction in our neighborhood and they are having a hard time putting crews together since you can make almost $1k a week sitting on your ass. Many people at my wife’s work are begging to be laid off since it would be a pay raise.I am struggling in every single one of my locations to bring furloughed people back and applications are down to a few a week. It’s really cramping growth.

It’s already V’coveredNo clue. It's all like a giant Ponzi scheme. IMO, the markets are priced completely out of sync with the realities of Main St. Between FOMO, hype about the Feds willingness to basically do anything to prop up the economy, and the new-wave of former-gamblers - now clueless daytraders further pumping up stocks without any regard to technicals - I think the markets are simply defying gravity... for now.

I'm at a loss as to how this all plays out. Should the Feds cut the $600/mo when it ends July 31st? Should they continue it? Or should they provide $ incentives to go back to work? How much of our kids and grandkids' money are we going to throw at the CV19 beast? We're already at what... $3+ TRILLION.

My guess is we have a vaccine by mid-2021. Until then, maybe we get some therapies to reduce deaths somewhat. Between now and then, I think the markets tank when the 2nd virus wave hits this Fall, and reality sets in that the markets pricing in a "V-recovery" was simply delusional.

It’s already V’covered

And as long as we don’t go out of our way to kill the economy again, all will be well.

Heh. The markets making a "V" does not the economy make.

All is far from well. Been out to see what's going on with sit-down restaurants? If open, they're at 50% capacity and basically no old people, period. Even with carry out, they're not making money. NOT A PENNY. They're only open because of the SBA PPP. I could say the same about alot of other sectors (theaters, bars, sports, pretty much any thing where there are normally crowds of people).

Basically, a best case synopsis of the current economic situation: Remove all senior citizens (55 and over) from any normal consumer (public) activity, and calculate what that does to our GDP. Minimum, I mean absolute minimum, subtract 10% from our annual GDP.

Plus, companies have LOADED UP on debt in preparation for a long-haul wait until things return to an actual 'normal'. This will harm profitability obviously.

Stocks are way, way out of sync with Main St. Driven by FOMO, newly-minted ignorant, homebound daytraders, and pumped up by this false notion that throwing money at CV19 by the Fed will cure-all, people are simply in for a rude awakening when this house of cards comes tumbling down.

We just came out of the longest economic expansion in our nation's history. Newton's Theory will come into play here. I'm banking on it.

Yea, we get it. You’re all doom and gloom, you’re banking on it.Heh. The markets making a "V" does not the economy make. The cart is pulling the proverbial horse.

All is far from well. Been out to see what's going on with sit-down restaurants? If open, they're at 50% capacity and basically no old people, period. Even with carry out, they're not making money. NOT A PENNY. They're only open because of the SBA PPP. I could say the same about alot of other sectors (theaters, bars, sports, pretty much any thing where there are normally crowds of people).

Basically, a best case synopsis of the current economic situation: Remove all senior citizens (55 and over) from any normal consumer (public) activity, and calculate what that does to our GDP. Minimum, I mean absolute minimum, subtract 10% from our annual GDP.

Plus, companies have LOADED UP on debt in preparation for a long-haul wait until things return to an actual 'normal'. This will harm profitability obviously.

Stocks are way, way out of sync with Main St. Driven by FOMO, newly-minted ignorant, homebound daytraders, and pumped up by this false notion that throwing money at CV19 by the Fed will cure-all, people are simply in for a rude awakening when this house of cards comes tumbling down.

We just came out of the longest economic expansion in our nation's history. Newton's Theory will come into play here. I'm banking on it.

Yea, we get it. You’re all doom and gloom, you’re banking on it.

And you’re conflating Wall St with Main St. They do not march in step.

The market trades ahead of the economic cycle. What do you think will happen in 2021? Investors are answering that question today.

Also true. If you think we're out of the woods on CV19, then being long here makes sense. Alternatively, if you're wrong...

Just one thing... How long does it normally take to develop a vaccine?

Sometimes there are shocks not priced in and the market got one from this virus after an all time high of 3,394 on 2/19/20. In only 23 trading days, the S&P was down 35% bottoming on 3/23/20. From that bottom it has climbed up 43% to today's close of 3,130. But keep in mind where we are. The market is still down 8% from all time highs. Any other time, with a pullback of 8%, you and the other lefties would be yelling about Trump and slobbering over getting the words recession spun into every news broadcast.

Eh, the markets have already priced in the lack of profits that are coming. It’s not a secret. Jmo.I am doom and gloom. Wasn't always this way.

You are correct, in part. The two aren't marching in step... but historically, this is fleeting. Hence my concerns that the markets are gonna tank.

Ask yourself this when it comes to the economy and the stock market: Which is the horse and which is the cart?

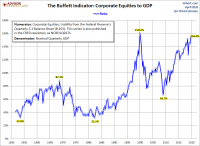

This illustrates where we are:

View attachment 290113

If you're long stocks, you've got a painful year coming up.