More than one way to skin that cat and I guess “rich” is arbitrary. I paid my last interest when I was 38 and retired comfortably at 55. I would have hated to of been carrying a bunch of debt through the 2 big market corrections but that’s just me.Using debt effectively and responsibly will make you rich.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone here into real estate investing?

- Thread starter BAJAvol

- Start date

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

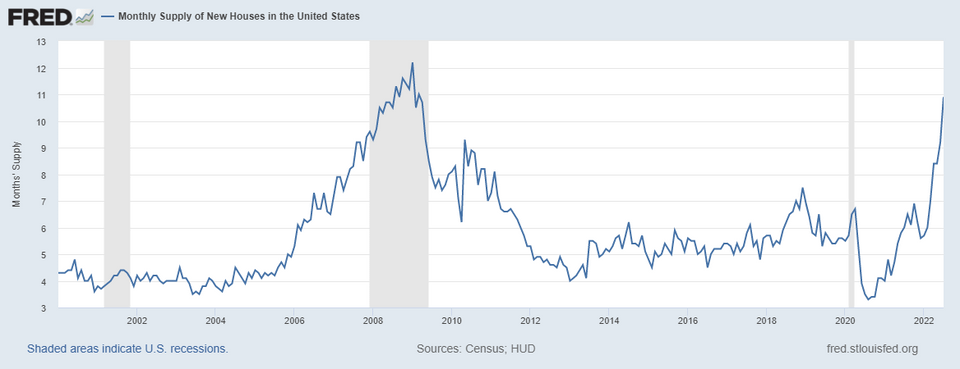

Strong correction is highly unlikely nationwide. Could it happen in spots, sure. There has only been one nationwide correction in housing prices in the last 100 or so years and that was in 2008. This is nothing like that. Foreclosures are basically nonexistent and that will only trickle back over time. Demand will vastly out pace supply for the next 3-5 years. People that think the sky is falling need to look at factual data and not go off feelings. Using emotion in real estate is how you lose your a**.

yoyoyoyo

Well-Known Member

- Joined

- Oct 30, 2009

- Messages

- 1,032

- Likes

- 1,551

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

Firebirdparts

Best tackle for his weight the old school ever had

- Joined

- Sep 13, 2014

- Messages

- 3,941

- Likes

- 6,741

EdEcEko77

Elite ★★★★★ Poster

- Joined

- Apr 5, 2009

- Messages

- 21,296

- Likes

- 141,213

My main strategy is the BRRRR. I love finding a piece of **** and doing a full Reno, and pulling the majority of my investment back out when I’m done. Then renting it at a $400 minimum cash flow. Hard to find these right now but my website ranks #1 for motivated sellers. I do flip as well if it’s a bigger house or there is too much money to be made.

I use a private lender now, but I use companies that use DSCR loans to do my refinances. Rates are higher but as long as I hit my cash flow target I don’t care. You just have to know your ARVs, Rents, and construction costs before you buy. You make your money when you buy. I am loving this market correction because people call me every day wanting me to buy their piece of **** house. For flips, look into a reputable hard money lender like Kiavi and Longhorn if they service your area. I also used 401k loans. Paid like 4% on the 401 loans to profit 72k on my last flip.

I own 4 rentals right now that average $425 per month in cash flow. All have been refinanced and I have left a total of $8,700 in all 4 deal combined. That’s like investing $8,700 for a 234% return. Real estate is king

Read BRRRR by David Greene. Also read the book on flipping houses by J Scott as well.

So much good info here. I appreciate it. Just ordered the two books mentioned off Amazon.

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

US home prices to plunge ‘substantially’ on ‘cratering’ demand: economistStrong correction is highly unlikely nationwide. Could it happen in spots, sure. There has only been one nationwide correction in housing prices in the last 100 or so years and that was in 2008. This is nothing like that. Foreclosures are basically nonexistent and that will only trickle back over time. Demand will vastly out pace supply for the next 3-5 years. People that think the sky is falling need to look at factual data and not go off feelings. Using emotion in real estate is how you lose your a**.

yoyoyoyo

Well-Known Member

- Joined

- Oct 30, 2009

- Messages

- 1,032

- Likes

- 1,551

BAJAvol

14 Beers Deep on the Lake Somewhere

- Joined

- Jan 13, 2010

- Messages

- 3,491

- Likes

- 3,204

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

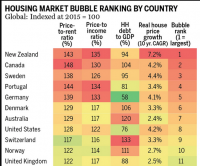

World’s Frothiest Housing Market Cools in Global Warning SignalI hope this does in fact happen (unlikely). Because as an investor, I will buy everything I can at a discount

Looks like you’ll know by the end of the year/ early next year. The US Fed started raising rates in June this year (and we are already seeing a major slow down). New Zealand started raising rates in October 2021, and they are currently in free fall with home values down double digits as of June.

BAJAvol

14 Beers Deep on the Lake Somewhere

- Joined

- Jan 13, 2010

- Messages

- 3,491

- Likes

- 3,204

Fed hikes typically only effect short term loans though like autos and helocs.World’s Frothiest Housing Market Cools in Global Warning Signal

Looks like you’ll know by the end of the year/ early next year. The US Fed started raising rates in June this year (and we are already seeing a major slow down). New Zealand started raising rates in October 2021, and they are currently in free fall with home values down double digits as of June.

Vol Farmer

Boogie Man

- Joined

- Jul 16, 2021

- Messages

- 887

- Likes

- 1,528

Velo Vol

Internets Expert

- Joined

- Aug 19, 2009

- Messages

- 36,533

- Likes

- 16,882

BAJAvol

14 Beers Deep on the Lake Somewhere

- Joined

- Jan 13, 2010

- Messages

- 3,491

- Likes

- 3,204

mrorange211

Well-Known Member

- Joined

- Dec 9, 2011

- Messages

- 6,018

- Likes

- 6,977

BAJAvol

14 Beers Deep on the Lake Somewhere

- Joined

- Jan 13, 2010

- Messages

- 3,491

- Likes

- 3,204

Picked up a pretty nice 4/3 in a great area of fountain city this week that I intend to flip.

here are the number break downs

purchase:$155,000

Estimated rehab; $90,000 (going high end)

Estimated ARV: $375,000

I could honestly probably get 400k out of this house but I want it to move quick so I can relax for the rest of the year lol.

here are the number break downs

purchase:$155,000

Estimated rehab; $90,000 (going high end)

Estimated ARV: $375,000

I could honestly probably get 400k out of this house but I want it to move quick so I can relax for the rest of the year lol.

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

BAJAvol

14 Beers Deep on the Lake Somewhere

- Joined

- Jan 13, 2010

- Messages

- 3,491

- Likes

- 3,204

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837

Big Orange#1

Veer and Shoot

- Joined

- Dec 8, 2010

- Messages

- 4,461

- Likes

- 14,837