Rasputin_Vol

"Slava Ukraina"

- Joined

- Aug 14, 2007

- Messages

- 70,893

- Likes

- 38,917

I've officially seen it all. We are doomed. If we have people like Larry Summers and Paul Krugman leading the philosophical charge for our economy, we will crash and burn.

The Conscience of a Liberal - Secular Stagnation, Coalmines, Bubbles, and Larry Summers

Negative interest rate = You are paying the banks to keep your money

The Conscience of a Liberal - Secular Stagnation, Coalmines, Bubbles, and Larry Summers

And as he (Larry Summers) also notes, in this situation the normal rules of economic policy dont apply. As I like to put it, virtue becomes vice and prudence becomes folly. Saving hurts the economy it even hurts investment, thanks to the paradox of thrift. Fixating on debt and deficits deepens the depression. And so on down the line.

This is the kind of environment in which Keyness hypothetical policy of burying currency in coalmines and letting the private sector dig it up or my version, which involves faking a threat from nonexistent space aliens becomes a good thing; spending is good, and while productive spending is best, unproductive spending is still better than nothing.

An economy that needs bubbles?

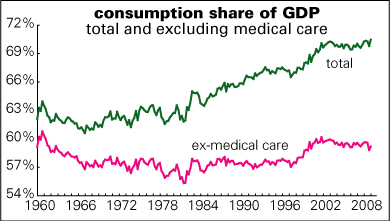

Summerss answer is that we may be an economy that needs bubbles just to achieve something near full employment that in the absence of bubbles the economy has a negative natural rate of interest. And this hasnt just been true since the 2008 financial crisis; it has arguably been true, although perhaps with increasing severity, since the 1980s.

Sidenote: Too me, this is just evidence of the generational Ponzi scheme that has finally run its course in Japan and the US/Western society. As long as you have a growing population and more people feeding into the system than taking from it, then the scheme will work.Now look forward. The Census projects that the population aged 18 to 64 will grow at an annual rate of only 0.2 percent between 2015 and 2025. Unless labor force participation not only stops declining but starts rising rapidly again, this means a slower-growth economy, and thanks to the accelerator effect, lower investment demand.

By the way, in a Samuelson consumption-loan model, the natural rate of interest equals the rate of population growth. Reality is a lot more complicated than that, but I dont think its foolish to guess that the decline in population growth has reduced the natural real rate of interest by something like an equal amount (and to note that Japans shrinking working-age population is probably a major factor in its secular stagnation.)

Of course, the underlying problem in all of this is simply that real interest rates are too high. But, you say, theyre negative zero nominal rates minus at least some expected inflation. To which the answer is, so? If the market wants a strongly negative real interest rate, well have persistent problems until we find a way to deliver such a rate.

One way to get there would be to reconstruct our whole monetary system say, eliminate paper money and pay negative interest rates on deposits. Another way would be to take advantage of the next boom whether its a bubble or driven by expansionary fiscal policy to push inflation substantially higher, and keep it there. Or maybe, possibly, we could go the Krugman 1998/Abe 2013 route of pushing up inflation through the sheer power of self-fulfilling expectations.

Negative interest rate = You are paying the banks to keep your money